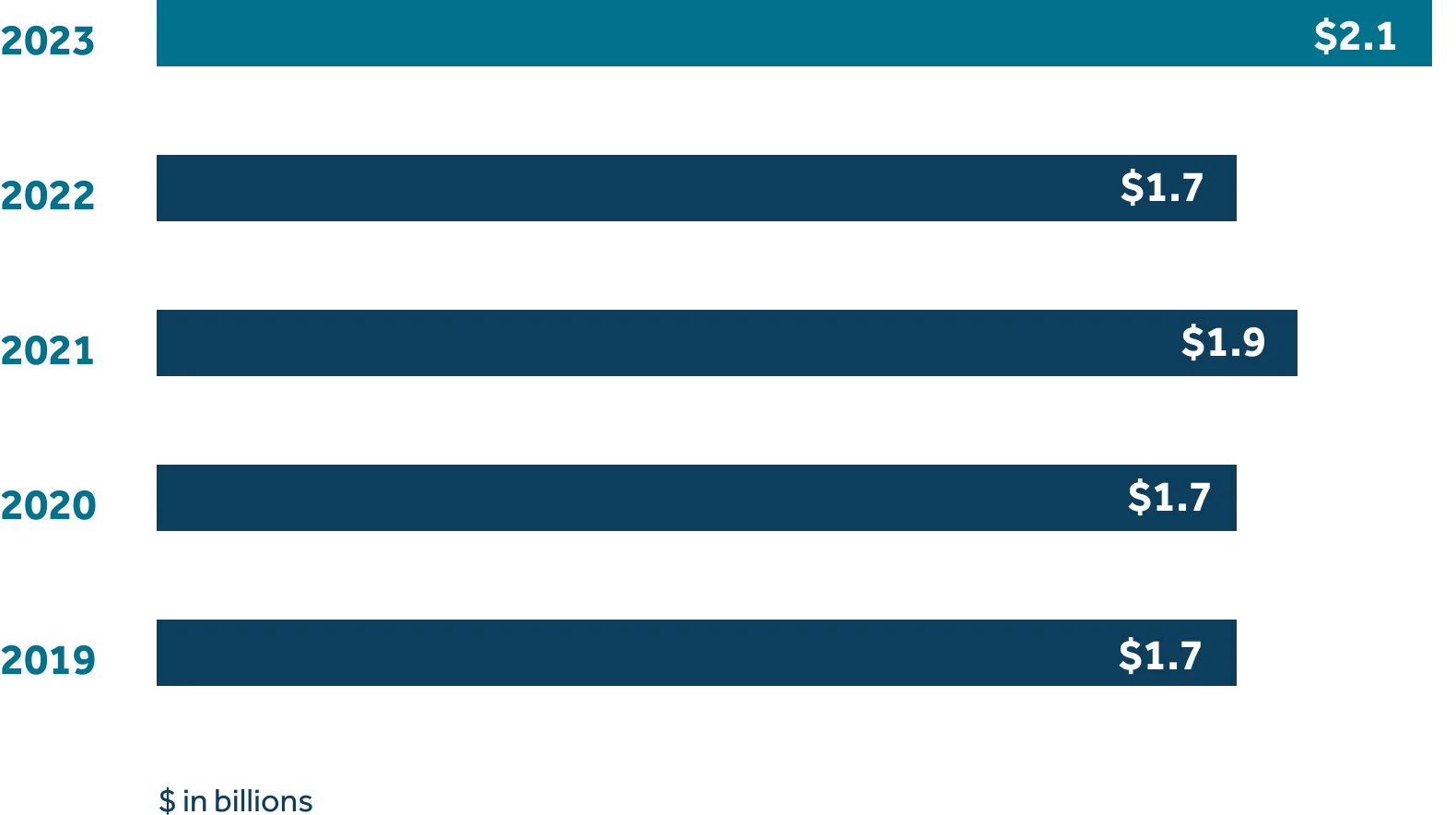

$2 billion

Surpassed an operating income of $2 billion for the first time in the company’s history

$11.4 billion

Ended the year with more than $11.4 billion of capital

$1.398 billion

Approved an all-time-high 2024 dividend of $1.398 billion and increased the dividend interest rate to 5.90%1

A++

Proudly continued to deliver some of the highest financial strength ratings in the industry

“Guardian’s results reflect strong business performance and investment returns buoyed by higher interest rates. Our risk management principles underpin our financial strength and enable us to pursue bold investment opportunities during uncertain times while others in the industry contend with constraints.”

Kevin Molloy

Chief Financial Officer

- Moody's Investors Service

Aa1

High Quality

2 of 21 - A.M. Best Company

A++

Superior

1 of 15 - Standard & Poor's

AA+

Very Strong

2 of 20

1 Dividends are not guaranteed. They are declared annually by Guardian's Board of Directors. The total dividend calculation includes mortality experience and expense management as well as investment results.

2 The ratings of The Guardian Life Insurance Company of America® (Guardian) quoted in this report are as of December 31, 2023 and are subject to change. The ratings earned by Guardian do not apply to the investments issued by The Guardian Insurance & Annuity Company, Inc. (GIAC) or offered through Park Avenue Securities LLC (PAS). Rankings refer to Guardian’s standing within the range of possible ratings offered by each agency.

Other legal information:

Financial information concerning Guardian as of December 31, 2023, on a statutory basis:

Admitted assets = $80.3 billion; liabilities = $71.2 billion (including $58.0 billion of reserves); and surplus = $9.1 billion.

Financial information concerning GIAC as of December 31, 2023, on a statutory basis:

Admitted assets $11.8 billion; liabilities = $11.3 billion (including $3.9 billion of reserves); and capital and surplus = $0.5 billion.

Financial information for Berkshire Life Insurance Company of America as of December 31, 2023, on a statutory basis:

Admitted assets = $5.2 billion; liabilities = $5.0 billion (including $1.1 billion in reserves); and capital and surplus = $0.2 billion.

1 Dividends are not guaranteed. They are declared annually by Guardian's Board of Directors. The total dividend calculation includes mortality experience and expense management as well as investment results.

2 The ratings of The Guardian Life Insurance Company of America® (Guardian) quoted in this report are as of December 31, 2023 and are subject to change. The ratings earned by Guardian do not apply to the investments issued by The Guardian Insurance & Annuity Company, Inc. (GIAC) or offered through Park Avenue Securities LLC (PAS). Rankings refer to Guardian’s standing within the range of possible ratings offered by each agency.

Other legal information:

Financial information concerning Guardian as of December 31, 2023, on a statutory basis:

Admitted assets = $80.3 billion; liabilities = $71.2 billion (including $58.0 billion of reserves); and surplus = $9.1 billion.

Financial information concerning GIAC as of December 31, 2023, on a statutory basis:

Admitted assets $11.8 billion; liabilities = $11.3 billion (including $3.9 billion of reserves); and capital and surplus = $0.5 billion.

Financial information for Berkshire Life Insurance Company of America as of December 31, 2023, on a statutory basis:

Admitted assets = $5.2 billion; liabilities = $5.0 billion (including $1.1 billion in reserves); and capital and surplus = $0.2 billion.